Alert

Corporate Transparency Act Burden Highlighted by Certain Holding Company Structures

Read Time: 9 minsMuch has been written about the filing requirements under the Corporate Transparency Act (CTA) in the last year. Currently, enforcement of the CTA has been placed on hold. On December 3, 2024, a federal district court in the Eastern District of Texas issued an order granting a nationwide preliminary injunction that (1) enjoins the CTA, including enforcement of that statute and regulations implementing its beneficial ownership information reporting requirements, and (2) stays all deadlines to comply with the CTA’s reporting requirements.

Nevertheless, should the injunction be lifted, reporting companies need to be prepared to comply with the CTA, especially considering that on Friday, December 13, 2024, the Department of Justice filed an emergency motion with the U.S. Court of Appeals for the Fifth Circuit to stay the preliminary injunction, “as soon as possible, but in no event later than December 27, 2024,” pending its appeal. If granted, reporting companies that have not filed their BOI reports would have less than a week to file.

See “Now What? – Texas Court Nationally Enjoins Corporate Transparency Act as ‘Likely Unconstitutional’,” and “And Now We Wait – DOJ Appeals to Fifth Circuit and FinCEN Makes a Statement on CTA Preliminary Injunction.”

Timing of BOI Report Filing

Under the CTA, all “reporting companies” formed before January 1, 2024, must file their initial Beneficial Ownership Information (BOI) report on or before January 1, 2025. Reporting companies formed after December 31, 2023, must file within 90 days after receiving notice of the company’s creation or, in the case of a foreign corporation, registration to do business in the United States. As referenced in our prior alerts, the BOI report is filed with the Financial Crimes Enforcement Network (FinCEN), which is an organization within the U.S. Department of Treasury.

See “What Does the Corporate Transparency Act Mean for Businesses and Incorporators?,” “Podcast: What Will the Corporate Transparency Act Mean for Your Business?,” “FinCEN Issues Access Rule, Small Entity Compliance Guide for Beneficial Ownership Information,” “Corporate Transparency Act Reporting Begins: Are You Ready?,” and Corporate Transparency Act Held Unconstitutional.

Types of Reporting Companies

There are two types of reporting companies:

1. Domestic reporting companies are corporations, limited liability companies, and any other entities created by the filing of a document with a secretary of state or any similar office in the United States.

2. Foreign reporting companies are entities (including corporations and limited liability companies) formed under the law of a foreign country that has registered to do business in the United States by the filing of a document with a secretary of state or any similar office.

Entities Exempt from Filing BOI Reports

Not all companies are required to file BOI reports. Twenty-three (23) types of entities are exempt from the reporting requirement. For example, these entities include publicly traded companies meeting specific requirements, many nonprofit organizations, companies that have certain reporting obligations to governmental entities (e.g., insurance companies, banks, federal or state credit unions, investment companies, registered public accounting firms, and public utilities), and certain large companies. For a list and description of the 23 exempt entities and the exemption criteria for each, see FinCEN’s Small Entity Compliance Guide.

Large Operating Company Exemption

Many companies may qualify for one reporting company exemption in particular, which is the large operating company. A company qualifies for this exemption if it meets each of the following six criteria:

- The entity employs more than 20 full-time employees.

- More than 20 full-time employees of the entity are employed in the United States.

- The entity has an operating presence at a physical office within the United States.

- The entity filed a federal income tax or information return in the United States for the previous year, demonstrating more than $5,000,000 in gross receipts or sales.

- The entity reported this greater-than-$5,000,000 amount as gross receipts or sales (net of returns and allowances) on the entity’s IRS Form 1120, consolidated IRS Form 1120, IRS Form 1120-S, IRS Form 1065, or other applicable IRS form.

- When gross receipts or sales from sources outside the United States, as determined under the Federal income tax principle, are excluded from the entity’s amount of gross receipts or sales, the amount remains greater than $5,000,000.

Given this definition of large operating company, it would be natural to assume that an enterprise wholly owned by a holding company that employs hundreds of employees and has gross receipts in excess of $100 million would qualify as a large operating company. Depending on the structure, this assumption could be wrong. Consider the fictional case of Yiaya Olga’s Souvlaki Kitchen.

Fictional Case of Yiaya Olga’s Souvlaki Kitchen

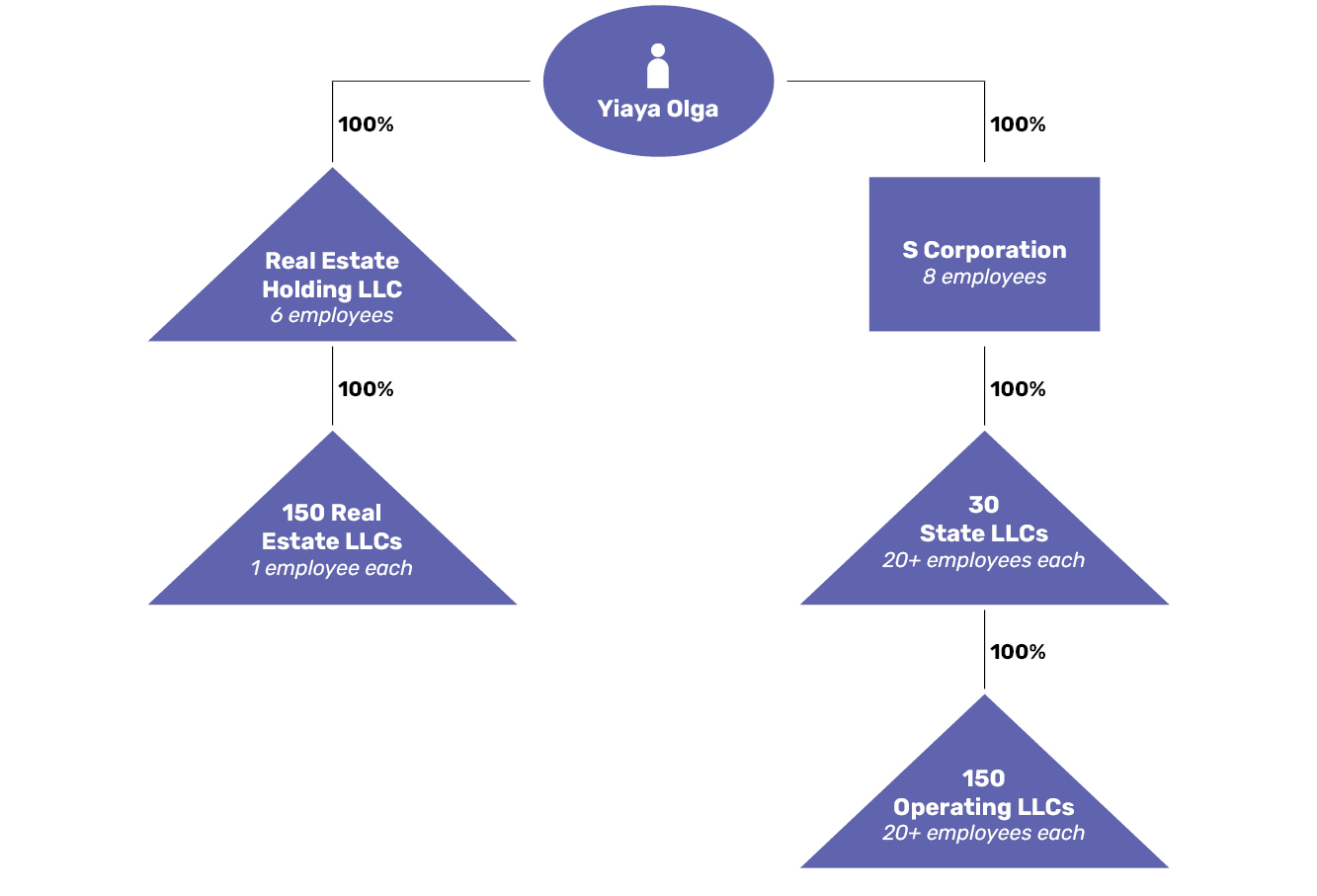

Yiaya Olga’s Souvlaki Kitchen operates restaurants in 30 states. The real estate of each restaurant is owned by an LLC, the sole asset of which is the real estate for that restaurant (a Real Estate LLC). Each Real Estate LLC is owned by a single LLC wholly owned by Yiaya Olga, a U.S. citizen (the Real Estate Holding LLC). Neither the Real Estate Holding LLC nor any of the Real Estate LLCs has made a check-the-box election to be treated as an association taxable as a corporation.

The operations of each restaurant are owned by a separate LLC (an Operating LLC). There are 150 Operating LLCs. For each state, there is an LLC that owns 100 percent of the Operating LLCs in that state (a State LLC). The LLC interests of all 30 State LLCs are owned by a single S corporation. The S corporation is wholly owned by Yiaya Olga.

Each Operating LLC and each State LLC employs more than 20 full-time employees. Each Real Estate LLC has one employee. The Real Estate Holding LLC employs six full-time employees. The S corporation employs eight full-time employees.

All employees are employed in the United States, and each entity has a physical operating presence in the United States.

Each Operating LLC’s annual gross receipts exceed $5,000,000 from U.S. operations. Although the Operating LLCs pay rent to the Real Estate LLCs, none of the real estate LLCs has annual gross receipts that exceed $5,000,000. However, the aggregate gross receipts of the Real Estate LLCs exceed $5,000,000. None of the Operating LLCs or State LLCs has filed a check-the-box election to be treated as an association taxable as a corporation. The S corporation has no direct operations. Its only source of gross receipts are those that pass through to it from the Operating LLCs and State LLCs.

Is the S Corporation a Large Operating Company?

No. $5,000,000 test. In determining whether the S corporation filed a Federal income tax or information return in the United States for the previous year demonstrating more than $5,000,000 in gross receipts or sales, the S corporation can include receipts or sales of other entities owned by it and other entities through which it operates. Although the S corporation has no receipts from its own operations, it exceeds the $5,000,000 threshold when the gross receipts of its directly and indirectly owned LLCs, which are disregarded entities, are included in its gross receipts.

Employee test. The S corporation has eight full-time employees. Each Operating LLC and State LLC has more than 20 full-time employees. To meet the employee test, the S corporation must have more than 20 full-time employees. It cannot count the employees of the Operating LLCs and State LLCs.

Because the S corporation fails the employee test, it does not qualify as a large operating company. The S corporation must file a BOI report showing Yiaya Olga as the beneficial owner.

Are the State LLCs Large Operating Companies?

No. Each State LLC has more than $5,000,000 in gross receipts when the gross receipts of the Operating LLCs are included and more than 20 full-time employees. Thus, it would appear that each meets the tests for a large operating company. Unfortunately, each State LLC technically fails the $5,000,000 test. The $5,000,000 test states that the entity “filed a Federal income tax or information return in the United States for the previous year demonstrating more than $5,000,000 in gross receipts or sales . . .” Each State LLC is a disregarded entity, which means that it does not file a Federal income tax or information return. Each State LLC’s gross receipts will pass through to the S corporation, which does file a Federal income tax return.

Are the Operating LLCs Large Operating Companies?

No. The Operating LLCs do not qualify as large operating companies for the same reasons that the State LLCs do not qualify. They fail the $5,000,000 test because, as disregarded entities, they do not file a Federal income tax or information return.

Are the Real Estate LLCs Large Operating Companies?

No. Because each Real Estate LLC has one full-time employee, each fails the employee test. Moreover, none of the Real Estate LLCs has more than $5,000,000 in gross receipts. Thus, none of the Real Estate LLCs qualify as a large operating company.

Is the Real Estate Holding LLC a Large Operating Company?

No. The Real Estate Holding Company LLC has more than $5,000,000 in gross receipts when the gross receipts of the Real Estate LLCs are included; however, it does not file a Federal income tax or information return because it is a disregarded entity. Thus, it fails the $5,000,000 test. It also fails the more-than-20-employee test because it has six employees.

Exception for Subsidiary of Exempt Reporting Company

One of the reporting company exemptions is for an entity that is wholly owned or controlled, directly or indirectly, by one or more exempt reporting companies.

Are the State LLCs Exempt Subsidiaries?

No. The State LLCs are wholly owned and controlled by the S corporation. Because the S corporation fails the employee test, it is not a large operating company and, therefore, an exempt reporting company. Thus, the State LLCs are not owned or controlled by an exempt reporting company.

Are the Operating LLCs Exempt Subsidiaries?

No. The Operating LLCs are wholly owned and controlled by the State LLCs. Because the State LLCs do not qualify as large operating companies or any other type of exempt reporting company, the Operating LLCs are not owned or controlled by exempt reporting companies.

Is the Real Estate Holding LLC an Exempt Subsidiary?

No. The Real Estate Holding LLC is wholly owned by Yiaya Olga, who is not an exempt reporting company.

Are the Real Estate LLCs Exempt Subsidiaries?

No. The Real Estate LLCs are wholly owned and controlled by the Real Estate Holding LLC. The Real Estate Holding LLC is wholly owned by Yiaya Olga. It does not file a Federal income or information return and therefore, fails the $5,000,000 test. It also fails the employee test. Because it does not qualify as an exempt reporting company, the Real Estate LLCs cannot qualify as entities owned or controlled by exempt reporting companies.

How Many BOI Reports Are Required?

Because none of the entities in Yiaya Olga’s Souvlaki Kitchen enterprise qualifies for the larger operating company exemption or subsidiary exemption, the enterprise must file the following BOI reports:

S corporation: 1 BOI Report

State LLCs: 30 BOI Reports

Operating LLCs: 150 BOI Reports

Real Estate LLCs: 150 BOI Reports

Real Estate Holding LLC: 1 BOI Report

Total: 332 BOI Reports

How Would the Result Change If the S Corporation Had More Than 20 Employees?

If the S corporation had more than 20 employees, it would satisfy the employee test and the gross receipts test and would qualify as a large operating company. Moreover, the State LLCs and Operating LLCs would qualify for the subsidiary exemption because they would be wholly owned, directly or indirectly, by a large reporting company. This would eliminate the need to file 180 BOI reports. BOI reports would still need to be filed for the 150 Real Estate LLCs and the Real Estate Holding LLC.

How Would the Result Change If the Real Estate Holding LLC Checked-the-Box To Be Treated As an Association Taxable As a Corporation?

If the Real Estate Holding Company checked-the-box to be treated as an association taxable as a corporation and filed an income tax return in the previous year demonstrating more than $5,000,000 in gross receipts, it would meet the $5,000,000 test because of the gross receipts passing through to it from the Real Estate LLCs. It still would fail the more-than-20 employee test because it only has six employees. It would need to meet the employee test to qualify as a large operating company.

The Real Estate Holding LLC could hire 15 more full-time employees to meet the employee test and qualify as a large operating company and no BOI report would be required for it. While qualifying as a large operating company would eliminate the need to file a BOI report for the Real Estate LLCs (they would qualify for the subsidiary exemption), it would cause the real estate to be held by a corporation for tax purposes. This would not be a good result for income tax purposes, even if the Real Estate Holding LLC made an election to be an S corporation.

Generally, real estate should not be held by a corporation, even an S corporation, when possible. For U.S. persons owning U.S. real estate, having a pass-through entity, such as a single member LLC of LLC taxed as a partnership, own the real estate generally is more tax efficient.

How Would the Result Change if the S Corporation Became a Member of the Real Estate Holding LLC?

If the S corporation became a member of the Real Estate Holding LLC, the Real Estate Holding LLC would become a partnership for federal income tax purposes. It would be required to file a partnership return, which is an information return. Because the Real Estate Holding LLC can include the gross receipts of the Real Estate LLCs, it would meet the $5,000,000 test. If it were to hire 15 more full-time employees, it would meet the employee test and qualify as a large operating company. It would own 100 percent of each Real Estate LLC. This would result in each Real Estate LLC qualifying as a subsidiary of an exempt reporting company. Thus, no BOI report would be required by the Real Estate Holding LLC or each of the Real Estate LLCs. Moreover, the real estate would continue to be owned by a pass-through entity.

How Would the Result Change if Yiaya Olga Became a Member of Each State LLC?

If Yiaya Olga became a member of each State LLC, each State LLC would become a partnership for federal income tax purposes. Each State LLC would be required to file a partnership return, which is an information return. Each would meet the $5 million test and the employee test, thereby qualifying each as a large reporting company. Because each State LLC owns 100 percent of the Operating LLCs in its state, the Operating LLCs that each State LLC owns would qualify for as a subsidiary of an exempt reporting company. Thus, no BOI report would be required for the State LLCs or the Operating LLCs.

Restructuring a holding company structure to reduce the number of BOI reports that must be filed may not be worth the effort, particularly when you consider the partnership information returns (IRS Forms 1065) that might need to be filed. It is important to remember, however, that a new BOI report must be filed whenever the information of a reporting entity changes, including its officers or address. Tracking these changes in a multi-entity structure could be challenging and minimizing the number of BOI reports that must be filed going forward could pay dividends in the long term.

Subscribe for Updates

Subscribe to receive emails from us regarding timely legal developments and events in your areas of interest.