Alert

Principal Payoff Option: A Viable Exception to the CFPB’s ATR Standard?

Read Time: 1 minThis article is the third in a series discussing the CFPB’s recently-issued Notice of Proposed Rulemaking, which covers Payday, Vehicle Title, and Certain High-Cost Installment Loans (the “Rule”). This article discusses the only type of loan that would be exempt from the Rule’s ability-to-repay requirements for covered short-term loans. This exempt transaction is known alternatively as the “Principal Payoff Option,” or as a “Section 7 Loan,” as it is designated under proposed 12 C.F.R. § 1041.7.

Recall that a loan is considered a “covered short-term loan” if it has a term of 45 days or less. A covered short-term loan would include a typical 14- or 30-day payday loan. Under the Rule, the lender is required to make a reasonable determination of the consumer’s “Ability-to-Repay” (“ATR”) prior to making a covered loan. Failure to do so is an abusive and unfair practice. For further analysis on the ATR requirements, please see our previous article, which discusses this topic at length.

The Section 7 Loan exemption provides a safe-harbor alternative to performing an ATR analysis. The CFPB believes the exemption would allow consumers to obtain fair credit terms and lenders to streamline compliance obligations. We do not expect this alternative to provide much in the way of compliance relief, as discussed below.

In summary, the Section 7 Loan alternative would allow lenders to extend up to three qualifying loans to a consumer in a sequence, during which the principal of each subsequent loan is reduced by one-third. Provided that this sequence is made correctly, and with the corresponding confirmation and disclosure requirements, the lender may make these loans without an ATR determination. The CFPB notes that these loans are only a partial exemption. Although Section 7 Loans will not be subject to ATR requirements, they will be subject to significant restrictions.

We look in turn at the following requirements necessary to make a sequence of Section 7 Loans: (1) following the loan structure limitations; (2) screening the consumer’s borrowing history; and (3) making the prescribed disclosures.

Section 7 Loan Structure

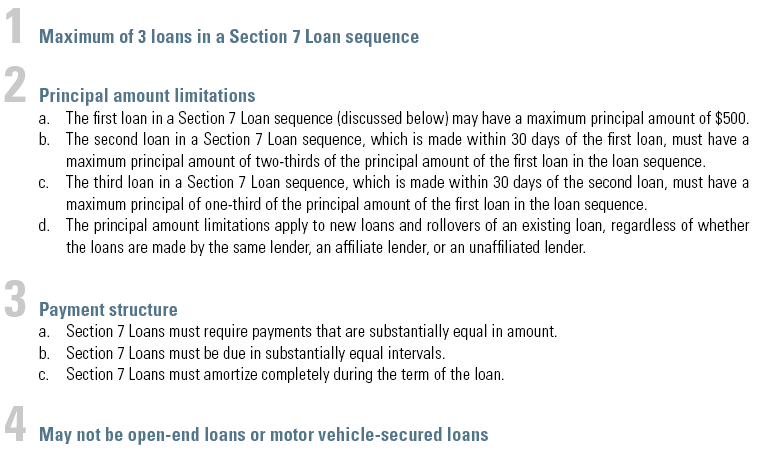

To qualify as a Section 7 Loan exempt from the ATR determination, a loan must comply with the following loan terms and structure requirements:

Borrowing History Requirements

Prior Loan History

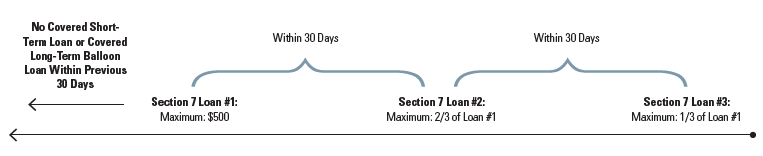

Prior to making a Section 7 Loan, the lender must determine that the consumer has not had an outstanding loan that was either a covered short-term loan or a covered longer-term balloon payment loan in the past 30 days. The requirement applies regardless of whether the prior loan was made by the same lender, an affiliate of the lender, or an unaffiliated lender.

The Lender is prohibited from making a Section 7 Loan if the loan would result in the consumer having a loan sequence of more than three Section 7 Loans made by any lender, including an affiliated or unaffiliated lender. Rollover loans also count towards the sequence limitation.

Registered Information System

To assess the consumer’s borrowing history prior to making a Section 7 Loan, the lender must obtain a consumer report from a “registered information system,” thus making the applicability of the exemption conditioned on the ability of a lender to utilize a registered information system. A registered information system is a reporting source registered with the CFPB to which lenders must furnish information about most covered loans at origination and from which lenders must obtain information from a consumer report about the consumer’s borrowing history. We will discuss the requirements of registered information systems in an upcoming article.

By tying the availability of Section 7 Loans to the accessibility of complicated registered information systems, the CFPB makes a Section 7 Loan impractical and possibly difficult to obtain. For example, a lender would not be able to make a Section 7 Loan if a registered information system is not available to provide a consumer report on the consumer’s borrowing history at origination. Additionally, a lender may be unable to obtain a report on the consumer’s borrowing history if registered information systems are not correctly registered or if technology failures make the information unavailable.

Section 7 Loan Limit and Indebtedness Limit

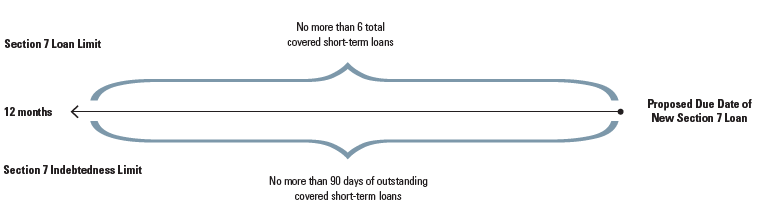

For a lender to extend a Section 7 Loan, the loan may not result in the consumer having more than six covered short-term loans, including non-Section 7 Loans, outstanding during any consecutive 12-month period, referred to as the “Section 7 loan limit.” Further, the Section 7 Loan may not result in the consumer having any covered short-term loans, including non-Section 7 Loans, outstanding for a total aggregate period of more than 90 days during any consecutive 12-month period, referred to as the “Section 7 indebtedness limit.” One limit is the number of loans; the other limit is time having outstanding loans. For example, four 30-day loans would be within the Section 7 loan limit, but would violate the indebtedness limit.

The consecutive 12-month period begins on the date that is 12 months prior to the proposed due date of the new Section 7 Loan and ends on the proposed due date of the new Section 7 Loan. To verify that the consumer qualifies for a Section 7 Loan, the lender is required to obtain a consumer report from a registered information system, which includes information about the consumer’s borrowing history for the 12 months in question. In the event that a loan was obtained before the 12-month period began, but is due during the 12-month period, both the loan and the time that it was outstanding during the 12-month period count toward the Section 7 loan limit and indebtedness limit.

Since the proposed Section 7 Loan is required to be included in the Section 7 loan and indebtedness limits, the lender must ensure that the consecutive 12-month period starts at the due date of the proposed Section 7 Loan.

Section 7 Loan Sequence Example

Taking into consideration the limitations on a Section 7 Loan Sequence, as set forth above, an example of a Section 7 Loan Sequence is as follows:

Disclosure Requirements

Lenders must provide certain disclosures before making the first and third loan in a Section 7 Loan sequence. The disclosures must be given to the consumer after the consumer has completed an application but prior to the consummation of the loan, and they are intended to provide consumers with information about the legal requirements and limitations of Section 7 Loans.

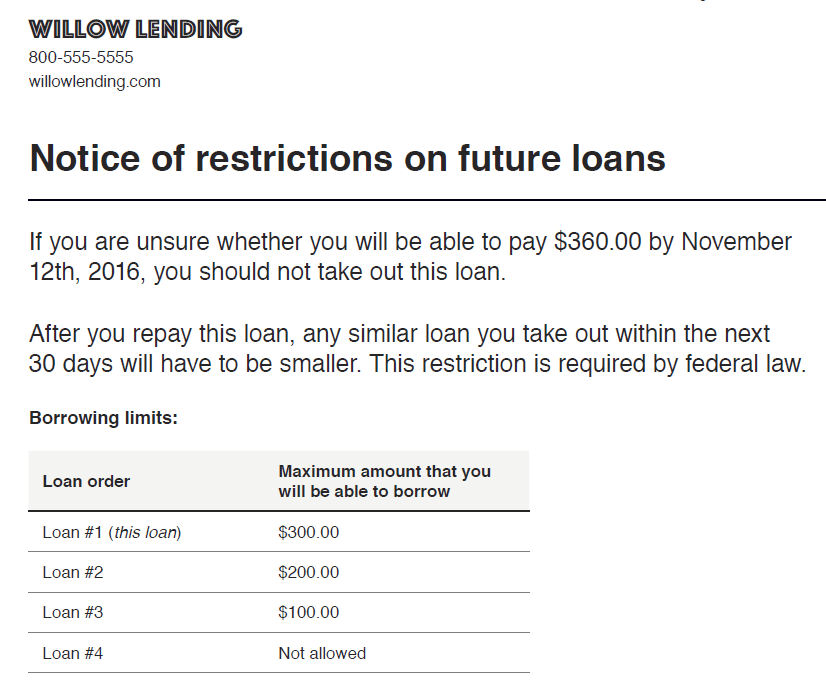

The lender of the first loan in a Section 7 Loan sequence must provide a specific disclosure to consumers. The Rule requires the first notice to incorporate: (1) The statement “Notice of restrictions on future loans”; (2) Warning as to the limits of Section 7 Loans, including inability to repay, the due date, and the total amount due; (3) Restrictions on subsequent loans; (4) Borrowing limits for each of the three loans in the sequence and that a fourth loan is not permitted; and (5) Lender name and contact information. The CFPB provides a model of the first notice in the appendix to the Rule, shown in the figure below.

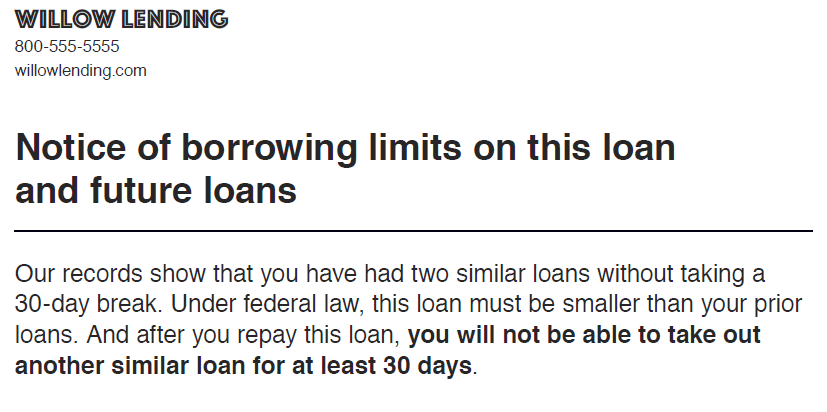

The lender of the third loan in a Section 7 Loan sequence must also provide a disclosure to consumers. The Rule requires the third notice to incorporate: (1) The statement “Notice of borrowing limits on this loan and future loans”; (2) A statement that the consumer has taken out two similar loans without taking a 30-day break between them; (3) A statement that the loan must be smaller than the previous two loans in the Section 7 Loan sequence; (4) a statement that informs that the consumer cannot take out a similar loan for at least 30 days after repaying the loan; and (5) Lender name and contact information. The CFPB provides a model of the third notice in the appendix to the Rule, shown in the figure below.

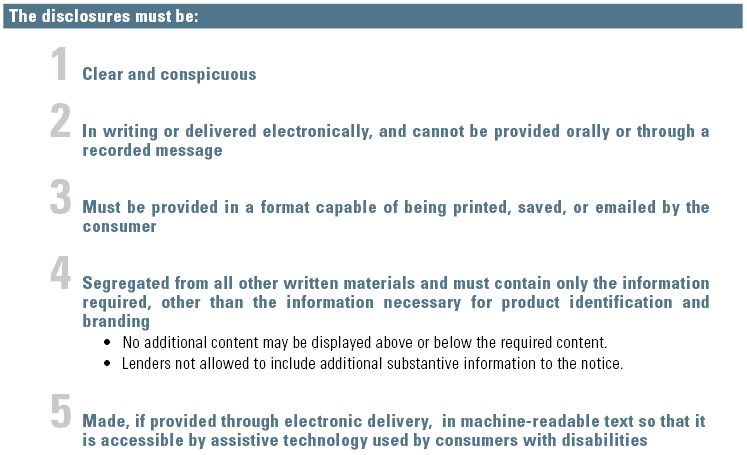

The Rule would require that the disclosures be substantially similar to the model disclosures, summarized below, and found in the Rule’s Appendix.

For consumers who speak English as a second language, lenders would be allowed to provide the disclosures in a foreign language, provided that the disclosures are available in English for consumers upon the consumer’s request. Although not required, providing these disclosures in languages other than English may help ameliorate possible UDAAP concerns associated with consumers with limited English proficiency.

Potential Opportunities and Traps for Lenders

OPPORTUNITIES

- Allows lenders to make loans to consumers in situations the CFPB considered to be “lower risk” without completing an ATR determination.

- Allows lenders to make repeat loans to consumers who meet the Section 7 Loan requirements.

TRAPS

- Does not provide lenders with flexibility in compliance.

- Potential high cost of compliance – devising a compliance program to ensure compliance with Section 7 Loan requirements will likely be expensive in comparison to the profitability of Section 7 Loans.

- Lenders are limited to availability and accessibility of registered information systems – lenders can only extend Section 7 Loans after obtaining borrowing history information about a consumer via registered information systems. If few or no registered information systems exist, then lenders will not be able to comply with the borrowing history requirements and a Section 7 Loan will not be available. Similarly, early users trying to extend Section 7 Loans may find that a borrower may not have sufficient loan history available in the registered information system.

Conclusion

The CFPB states that its creation of the Principal Payoff Option and the Section 7 Loan will make it easier for lenders to provide consumers with much-needed credit. Although this exception to the ATR requirements will be difficult for lenders to meet, it provides an additional product for lenders to offer consumers. We can help you create a compliant short-term loan product and build a robust compliance program to offer Section 7 Loans to consumers.

Click here to download this alert as a PDF.

For further information on this topic, please contact a member of the firm’s Consumer Financial Services Group.